tax per mile reddit

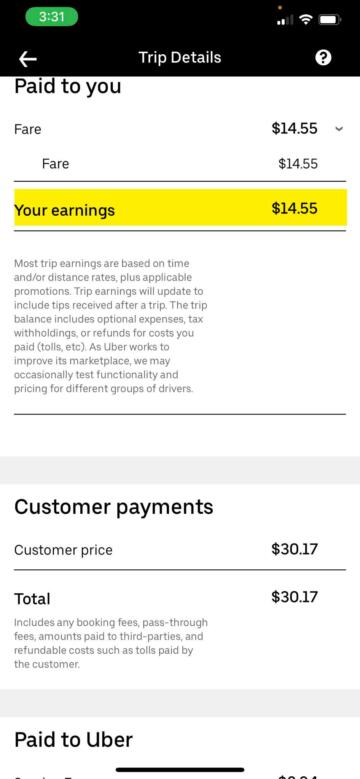

Deductible business miles include driving to work-related functions meeting clients and going to job sites. Due to taxes she only received about 6800 of that money.

Infrastructure Bill Includes Per Mile Road Tax Test That Will Track Drivers Travel R Futurology

Americans should not allow GPS tracking of cars trucks.

. Uhm that has nothing to do with you makinglosing money per mile. 19 cents per mile driven for medical or moving purposes. The rate for business travel expenses has dropped from 575 cents per mile in the 2020 tax year to 56 cents per mile for 2021.

54 cents per mile for business miles driven. However electrics dont pay this taxfee and drive as many miles as they like on our roads for free. 18 cents per mile.

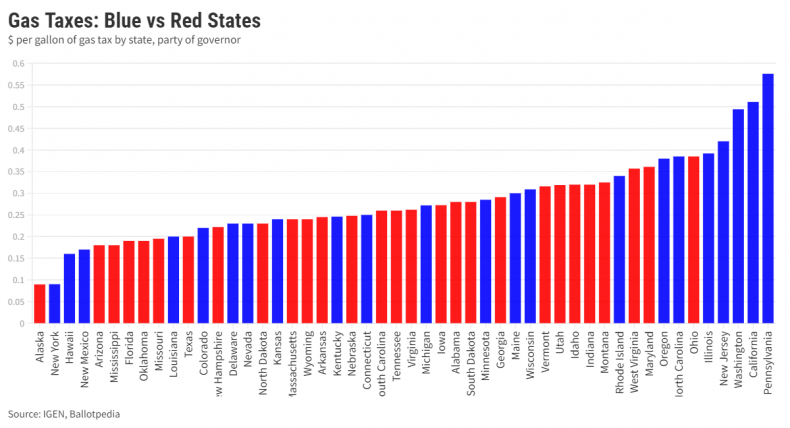

Simply put if you drive a vehicle you would pay money to the government for. Posted by 7 years ago. Fuel efficient cars are depleting the usual influx of gas tax revenues that pay for road and bridge upkeep.

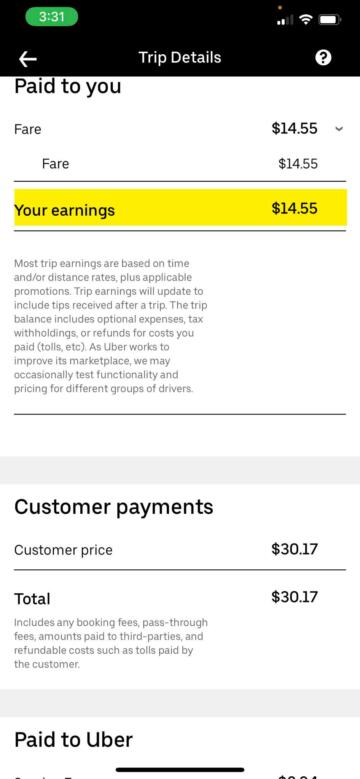

Medical and moving mileage. For July 1 - Dec 31 yes. Officially losing money per Mile.

However after a couple months she decided to go a different direction and left that job. Almond milk production alone kills 4 billion bees Whereas 1 cow provides almost 500 lbs of meat. Uber is paying 057mile and standard tax deduction is 058mile so every mile you drive youre losing 001 thats why you make money but you never have money fill your taxes properly.

19 cents per mile. Tax Per Mile Cometh. In 2019 Oregon lawmakers expanded their VMT program and prohibited cars that get fewer than 20 miles per gallon from participating in the program moving forward.

56 cents per mile. The standard mileage rates for the use of a car also vans pickups or panel trucks are. Studies estimate that producing the same amount of plant protein as animal protein kills at least 25 times more animals.

Someone driving about 11500 miles a. A driving tax proposed by President Joe Biden would cost Americans 8 cents per mile. Yet the new per-mile user fee pilot outlined in section 13002 of the bill does leave those people open to tax vulnerabilities pegged to personal vehicle mileage.

Tilling the soil slaughters mice rabbits and rodents. Ryan Stubbs Good morning. Everlance X Doordash Live Tax Q A With A Tax Expert Jan 24 2020 Youtube If you paid 300 in interest and 50 of miles are business you can deduct 150.

Oregons tax rate of 18 cents per mile is equivalent to the 36-cent gas tax paid by a vehicle that gets 20 miles per gallon. We do pay per mile. 585 cents per mile.

Pennsylvania which has the highest fuel tax in the nation at 587 cents per gallon recently began discussions on whether or not an 81-cent-per-mile tax was appropriatethis would translate. Its called a fuel tax on every gallon of gas or diesel. Search all of Reddit.

A tax per mile. What S Your Single Highest Paying Load Ever. 54 cents per mile for business miles driven.

The first major concern with a per-mile tax is in how the data would be collected. A per-mile usage tax provides a workaround however for those reluctant to change the gas tax and at the same time may provide Uncle Sam with much more than just revenue all at your expense. The standard mileage rate allows you to claim a business expense of 575 cents per mile driven for your Doordash and other deliveries for the 2020 tax year 56 cents per mile.

In section 13002 of the bill the pilot outlines that data can be. Log In Sign Up. So NH is among a handful of states considering replacing the gas tax with a Vehicle Miles Traveled VMT tax instead.

June 4 2019 154 PM. 14 cents per mile driven in service of charitable organizations. Standard Mileage Rate for Business.

My wife started a new job and received a 10000 starting bonus. 16 cents per mile. My solution is not to find a way to tax them AND fuel vehicles by the mile plus gas tax.

Text above the screenshot adds the. While Congress and the states kick around proposals to increase funding for infrastructure Robert Atkinson an opinion writer for The Hill has backed the idea of charging big rigs taxes based on the number of miles they driveCertainly not a new idea pilot programs for a per mile tax have been ongoing in several states although. A vehicle mileage tax or vehicle miles traveled fee would charge motorists a fee based on how many miles they drive.

We do pay per mile. A tax per mile. Veganism means killing the fewest animals.

206 of the 611 vehicles in Oregon. The rate for business travel expenses has dropped from 575 cents per mile in the 2020 tax year to 56 cents per mile for 2021. The timing of a vote on a 12 trillion infrastructure package divided House Democrats this week.

Aug 8 2021. Due to not fulfilling her contract she had to pay back the full 10k to the company even though she didnt actually receive that much. Mileage rate per mile.

Reddit Dogecoin Support Nascar Racer At Talladega Cnn Business

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

Infrastructure Bill Includes Per Mile Road Tax Test That Will Track Drivers Travel R Futurology

Editorial Biden Brings Back Road Usage Tax Plan

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_image/image/69847422/1233506003.0.jpg)

How To End The American Dependence On Driving Vox

The Absolute Best Doordash Tips From Reddit Everlance

The Great Fake Child Sex Trafficking Epidemic The Atlantic

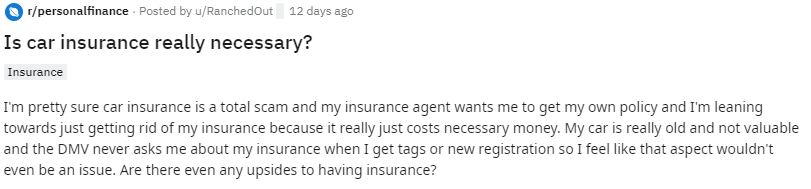

A Guide To Car Insurance According To Reddit Quotewizard

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

Irs Increases Mileage Rate To 58 5 Cents Per Mile For 2022 Grossman St Amour Cpas Pllc

The Best Times To Doordash In 2021 With Tips From Reddit

A Guide To Car Insurance According To Reddit Quotewizard

Biden S New Vehicle Mileage Tax Program Will Charge Per Mile Driven Possibly Affecting Pizza Delivery Drivers Significantly R Talesfromthepizzaguy

Secretive Algorithm Will Now Determine Uber Driver Pay In Many Cities The Markup

Secretive Algorithm Will Now Determine Uber Driver Pay In Many Cities The Markup

A Guide To Car Insurance According To Reddit Quotewizard