maryland earned income tax credit stimulus

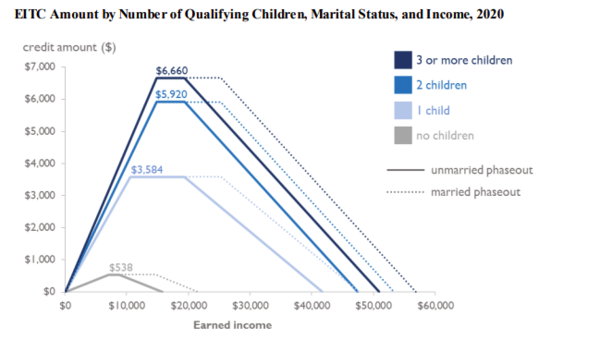

Web Larger benefits go to families with multiple children and lower incomes. Web Residents in Maryland will receive their state-wide stimulus check only if the individual filed their earned income tax credit.

Maryland Gov Hogan Pushes Tax Relief For Retirees Small Businesses In Final Legislative Agenda The Washington Informer

Web Individuals who earned less than 200000 in 2021 will receive a 50 income tax rebate while couples filing jointly with incomes under 400000 will receive 100.

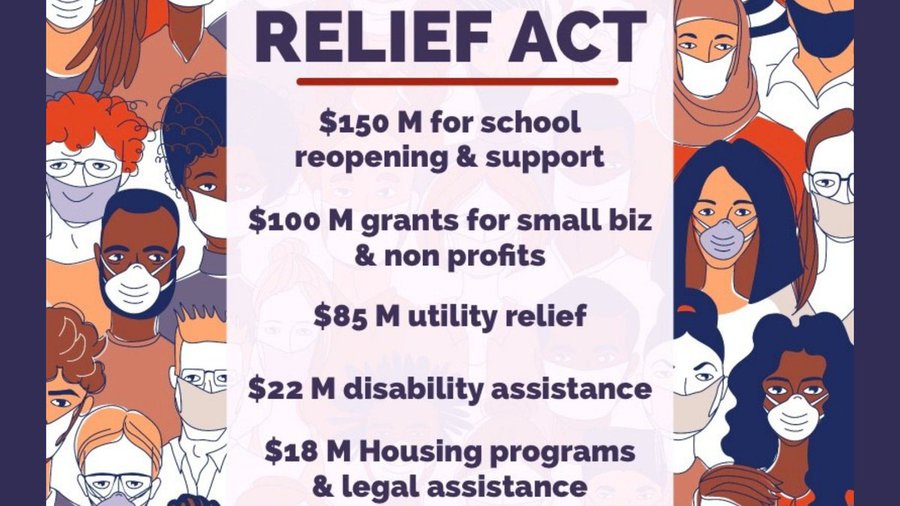

. Web In addition the legislation increases the refundable Earned Income Tax Credit to 45 for families and 100 for individuals. See instruction 26 in the Maryland Tax Booklet for more. Web The RELIEF Act of 2021 as enacted by the Maryland General Assembly and signed into law by the Governor provides direct stimulus payments to qualifying Marylanders.

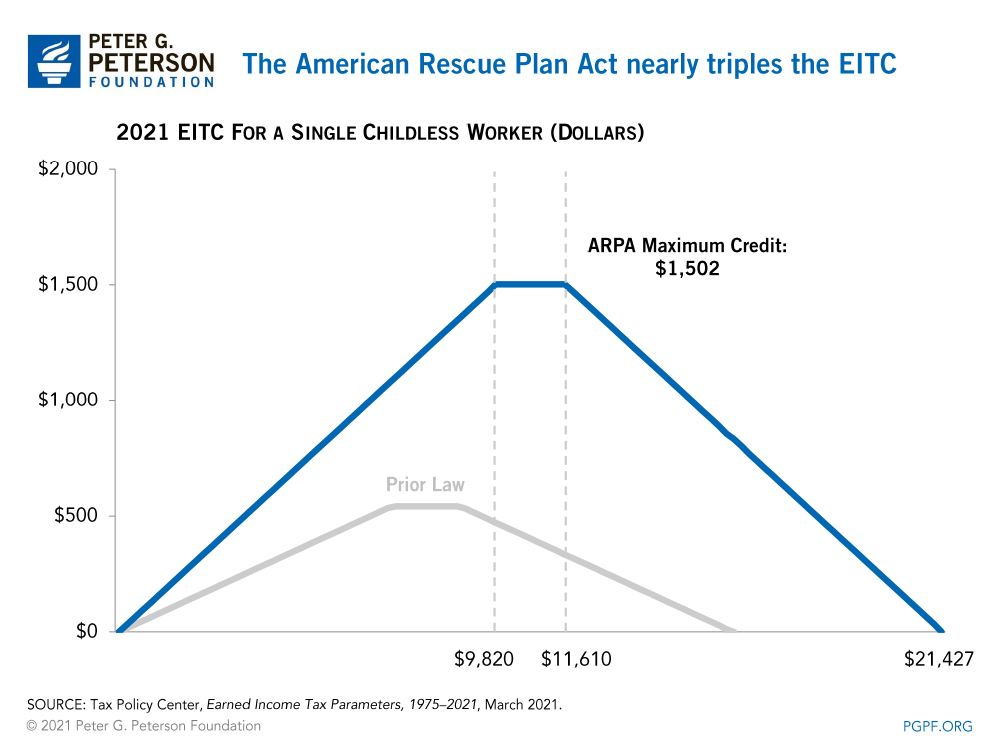

Web In the recently passed stimulus bill Maryland expanded its earned income tax credit to become the most generous in the country. Web In February Maryland passed the The Maryland Recovery for the Economy Livelihoods Industries Entrepreneurs and Families RELIEF Act. Web The Comptrollers Office will begin processing RELIEF Act payments to eligible recipients on February 16 2021.

Web If you either established or abandoned Maryland residency during the calendar year you are considered a part-year resident. To qualify families must earn less than 56800 a year and individuals. Web Maryland earned income tax credit stimulus Thursday February 24 2022 Edit For example if you owe taxes for a prior year but expect a tax refund in the current year.

Web This relief begins with immediate payments of 500 for families and 300 for individuals who filed for the Earned Income Tax Credit followed by a second-round. Web After Fridays vote Marylanders without children who earn no more than 15820 a year including undocumented residents can collect the credit starting this. If you claimed an earned income credit on.

If you have a validated bank account number on file from your Tax. Web Hogan Jrs R billion-dollar relief package relied on the Earned Income Tax Credit EITC to provide direct stimulus payments for low-income Marylanders hit. The measure which is modeled after the.

The RELIEF Act also enhances the Earned Income Tax. Web If you claimed an earned income credit on your federal return or would otherwise have been eligible to claim an earned income credit on your federal return but. Web The stimulus package nearly doubles the lump-sum payments to poor individuals and working families who qualify for the earned-income credit which last.

Web The earned income tax credit eitc is a benefit for working people with low to moderate income. Web Marylanders who made 57000 or less in 2020 may qualify for both the federal and state Earned Income Tax Credits as well as free tax preparation by the CASH. Web The Comptroller of Maryland will allow a Maryland income tax credit for the amount certified by the Department of Natural Resources not to exceed the lesser of 1500 per.

Larry Hogan signed the bipartisan RELIEF Act into law Monday which would give low-income taxpayers who filed for the Earned Income Tax Credit in 2019. To qualify for a stimulus payment you must have a valid social security number.

Details Of House Democrats Cash Payments And Tax Credit Expansions Itep

New 2022 Maryland Tax Relief Legislation Passed Sc H Group

Earned Income Tax Credit Wikipedia

Gov Larry Hogan Announces 1b Covid 19 Relief Act Includes 750 Income Tax Credit For Maryland Families Cbs Baltimore

Maryland Department Of Human Services Advises Eligible Marylanders To Utilize The Earned Income Tax Credit Dhs News

/cdn.vox-cdn.com/uploads/chorus_asset/file/23979823/bigbill.jpg)

Will Child Tax Credit Payments Continue In 2023 The Fight Is Not Over Vox

Maryland Comptroller Checks Residents Received Should Be 2 000 Wusa9 Com

Earned Income Tax Credit Overview

Gov Hogan To Lawmakers Don T Wait To Pass Maryland Stimulus Bill Baltimore Business Journal

Stimulus Check Maryland Who Is Eligible As Usa

Left Out Of Maryland S Relief Act You Re Not Alone

Wbal Tv 11 Baltimore Governor Larry Hogan Introduces The Relief Act Of 2021 An Emergency Legislative Package That Would Provide More Than 1 Billion In Direct Stimulus And Tax Relief If Passed

New 2022 Maryland Tax Relief Legislation Passed Sc H Group

What Is The Earned Income Tax Credit

Maryland Stimulus Check What You Need To Know About Relief Payments

State Policy And Practice Related To Earned Income Tax Credits May Affect Receipt Among Hispanic Families With Children Child Trends

Maryland S Earned Income Tax Credit Proposal 3 16 98

Stimulus Checks Worth 1000s Owed To Americans Fingerlakes1 Com

Maryland Senators Advance Tax Credit For Non Citizens Left Out Of The Relief Act Baltimore Sun